Multi-car accidents: Who’s at fault?

Image

In most car accidents involving two vehicles, the car behind is often held liable on the basis of not keeping a safe braking distance. However, when it comes to accidents involving multiple cars, things can get complicated. Here are 3 common scenarios:

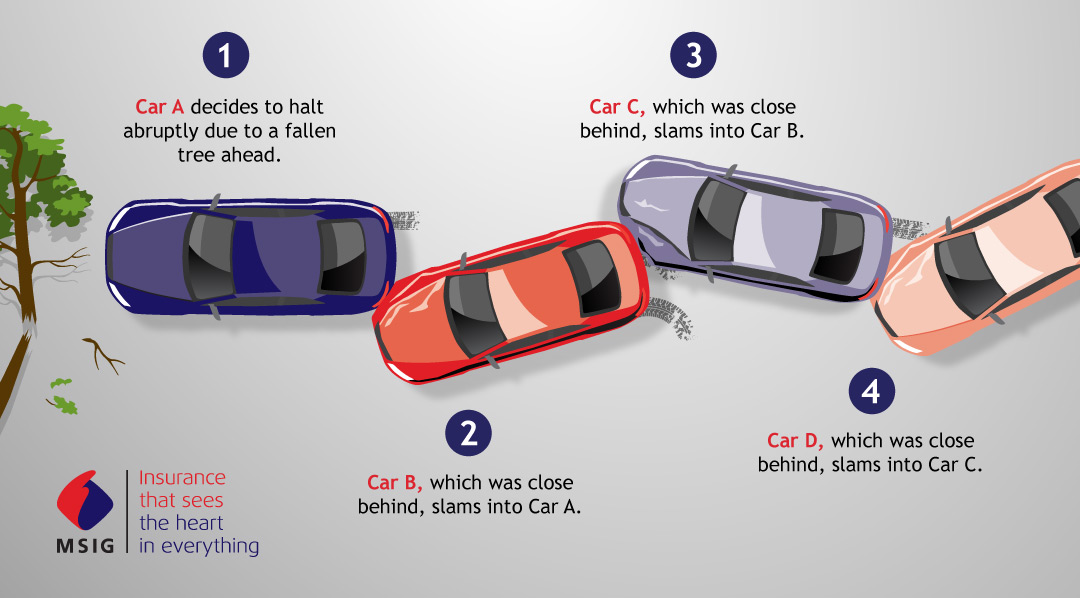

Scenario A:

In this case, Car B, C, and D all failed to keep a safe braking distance and were unable to stop in time.

They are all liable for the cars they rear-ended each. Only Car A is not at fault.

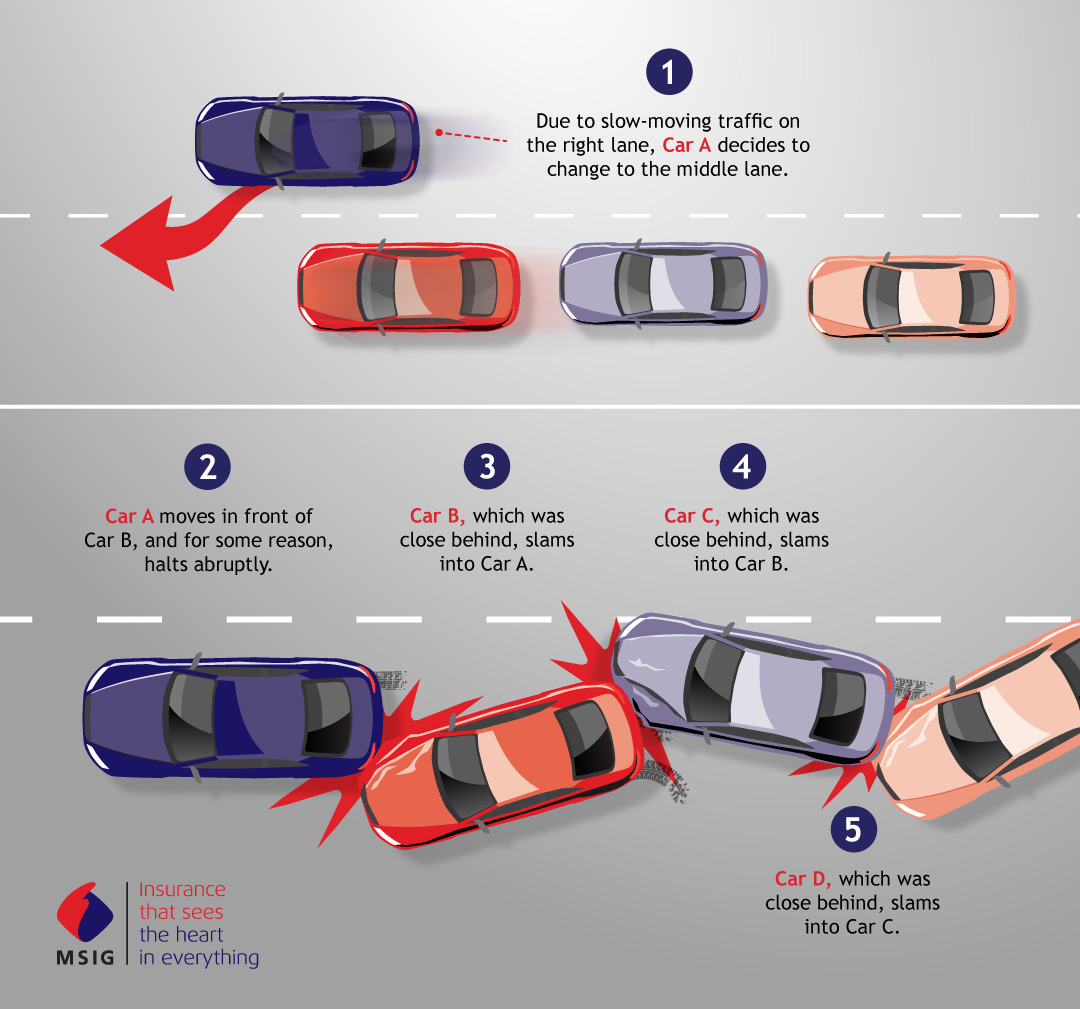

Scenario B:

In this case, Car D would be liable for all damages caused in the chain collision due to his failure to keep a safe braking distance.

Scenario C:

While this case closely resembles Scenario A, it has additional complications. In the majority of cases, the car(s) at the back are liable for the accident due to a failure in keeping a safe braking distance. Without camera evidence of Driver A’s reckless driving behaviour, he could be able to avoid liability even though he is at fault. That is why installing a front and rear car camera is so important. In cases where there is a lack of evidence, hiring a lawyer and/or having eyewitnesses would be Driver B, C, and D’s best chances of avoiding liability.

- Stay calm. Switch on hazard lights immediately and place the hazard sign at a noticeable distance behind your car.

- If there are any physical injuries, call the police and ambulance immediately.

- Take photos of the accident scene, as well as the damage to surrounding structures and vehicles (including license plates) from different angles.

- Move your vehicle to the side of the road if it is causing significant congestion to traffic. However, you should only do so if there are no injuries or deaths, and only after you’ve taken photos of the scene.

- Collect information from involved parties, such as full name, mobile number, home address, and insurer details. If possible, take down the contact details from any eyewitnesses too.

- Contact your insurer. A report should be made regardless of whether you intend to claim from your insurer or the third party.

The role of car insurance:

When it comes to multi-car crashes, it can be very difficult to establish who was at fault. While police investigators can strive to do their best to determine the liability fairly, it may not always be in your favour—especially if your car has no cameras installed and there is no evidence to support your case.

This is where insurance comes in handy. A good car insurance policy can help to reduce your liability and cover the damage done to other vehicles. It is valuable in Scenario B, where the driver has a number of claims stacked against him. It is especially helpful in Scenario C where the drivers are at fault only in the eyes of the unsuspecting law. However, subject to your policy terms, do note that you may still need to pay an excess before your insurer pays out your full liability.

Car accidents are never straightforward, not even if it only involves two vehicles. If you want to find out more about car insurance, click here or reach out to us here.